New Year, Same Housing Market

Quick Take:

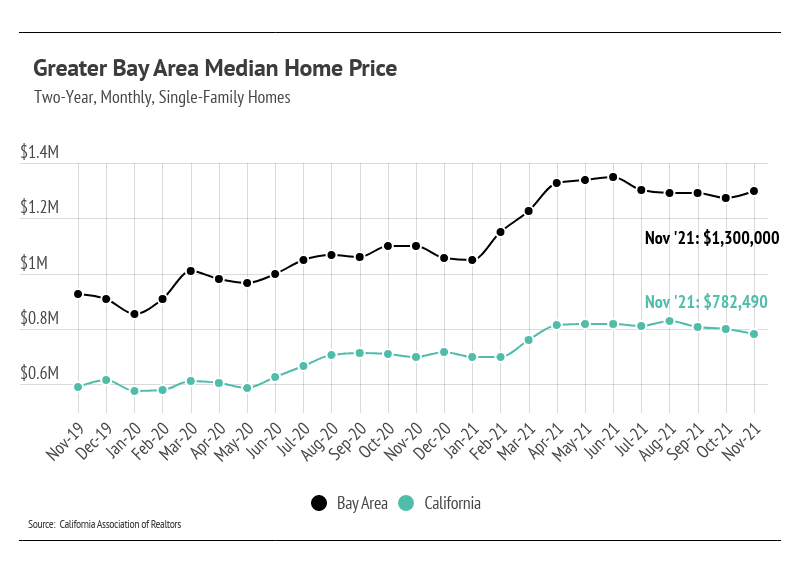

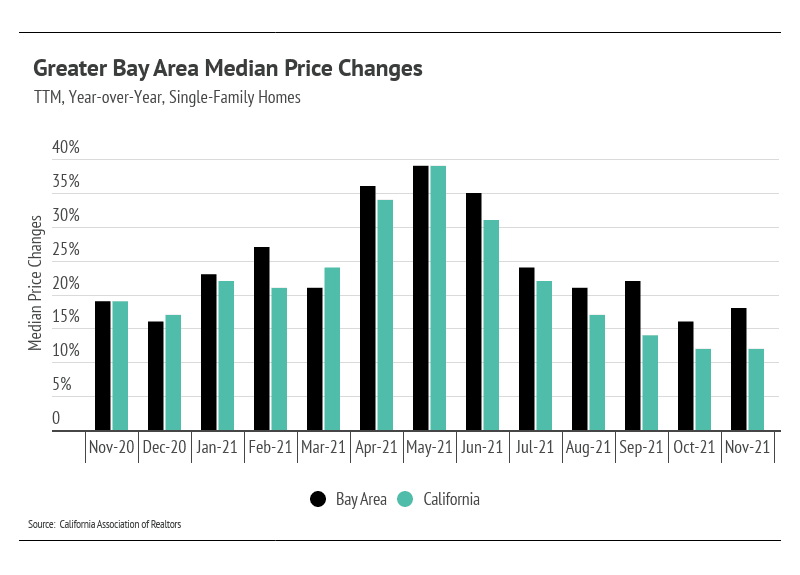

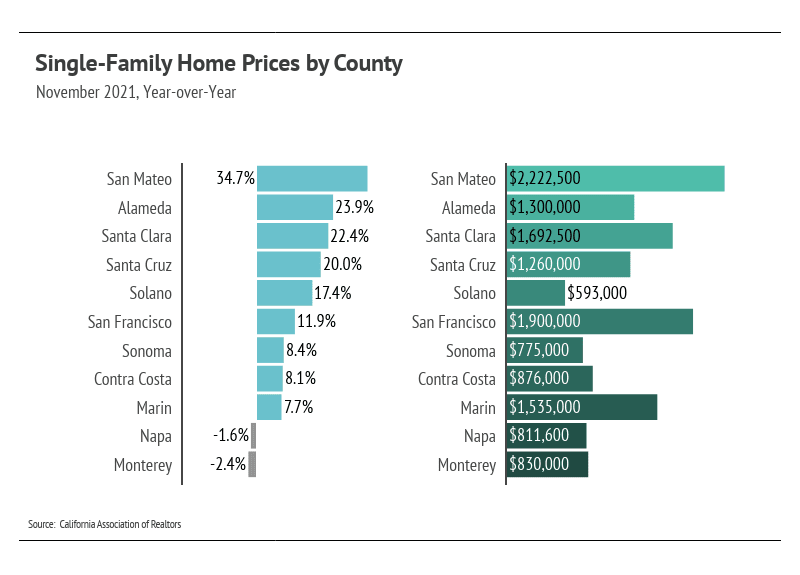

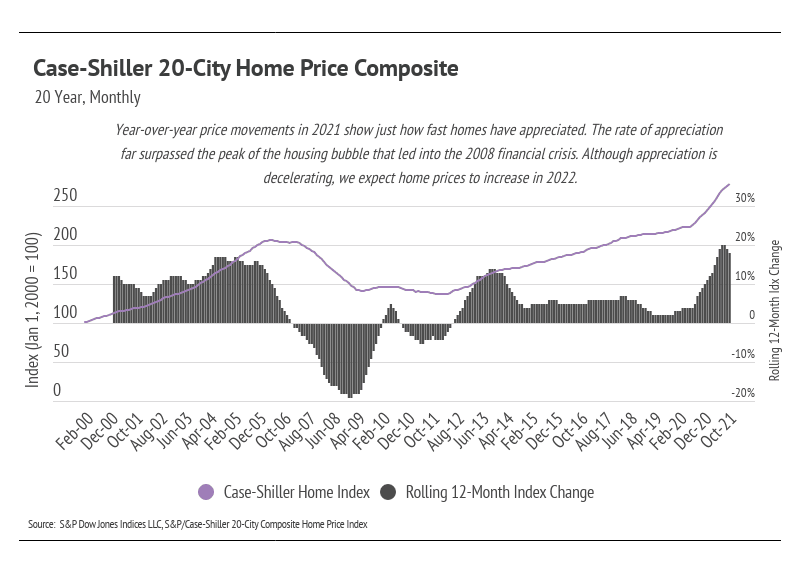

- Historically low supply continues to drive up home prices across the nation. However, home price increases are decelerating after the record-setting gains experienced over the past two years.

- The number of homes sold in 2021 is one of the highest on record.

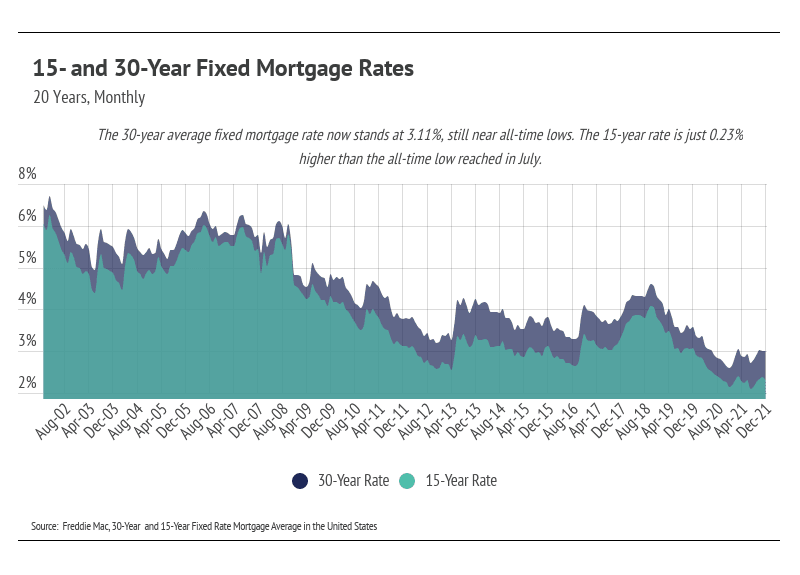

- Current inflation levels imply a negative borrowing rate because mortgage rates are below 6%. This means that borrowers are getting paid to borrow and should pay as little principle as possible until inflation recedes.

- The average 30-year fixed mortgage rate remained historically low, at 3.11% at the end of December 2021. But the Fed has indicated there will be at least two rate hikes in 2022.

Will the housing shortage reverse?

The driving force behind the substantial price increases over the past two years has been the supply of homes, or lack thereof. So, will the housing shortage reverse? The answer is no, as there is no reasonable scenario that would bring active listings to pre-pandemic norms. Before February 2020, seasonal inventory typically peaked in the summer months, but it was trending slightly lower each year. In 2016, inventory peaked at 1.55 million active listings, and by 2019, the peak fell to 1.35 million homes. Inventory in 2021 reached its highest point at approximately 621,000, a 54% decline over two years. Homebuilders simply cannot build fast enough, especially in sought-after urban areas that have already been developed, and new listings are peaking far lower than the historical seasonal norms.

At the same time, we are on pace to see around a million more homes sold in 2021 than in a typical year, based on the long-term average. In other words, more homes are selling, despite the historically low inventory, which is further driving down inventory. In 2022, we expect demand to remain elevated and supply depressed, which should keep home prices from depreciating.

Price appreciation likely will not see the record gains we experienced over the past two years, which is actually good. If we learned one thing from the mid-2000s, we know that we don’t want another housing bubble. The deceleration in price increases, therefore, actually benefits the current market. From a practical standpoint, home prices rising at 20% per year is unsustainable and would certainly cause a major collapse. Moving through 2022, we expect year-over-year price increases to move back to historical norms, in the 5–10% range.

Fed rate hikes in 2022 could drastically affect appreciation as well, which, again, isn’t a bad thing. The low-cost financing we’ve seen over the past two years could be coming to an end (although it’s difficult not to take a believe-it-when-I-see-it-approach to rate increases). When we account for current inflation, which is the highest it’s been since 1981, the real rate of borrowing is negative if you borrow at a rate below 6.8%. Simply put, you’re getting paid to borrow! We don’t expect this phenomenon to last long — it’s a fairly unique situation.

The market remains competitive for buyers, but conditions are making it an exceptional time for homeowners to sell. Low inventory means sellers will receive multiple offers with fewer concessions. Because sellers are often selling one home and buying another, it’s essential that sellers work with the right agent to ensure the transition goes smoothly.

At the same time, we are on pace to see around a million more homes sold in 2021 than in a typical year, based on the long-term average. In other words, more homes are selling, despite the historically low inventory, which is further driving down inventory. In 2022, we expect demand to remain elevated and supply depressed, which should keep home prices from depreciating.

Price appreciation likely will not see the record gains we experienced over the past two years, which is actually good. If we learned one thing from the mid-2000s, we know that we don’t want another housing bubble. The deceleration in price increases, therefore, actually benefits the current market. From a practical standpoint, home prices rising at 20% per year is unsustainable and would certainly cause a major collapse. Moving through 2022, we expect year-over-year price increases to move back to historical norms, in the 5–10% range.

Fed rate hikes in 2022 could drastically affect appreciation as well, which, again, isn’t a bad thing. The low-cost financing we’ve seen over the past two years could be coming to an end (although it’s difficult not to take a believe-it-when-I-see-it-approach to rate increases). When we account for current inflation, which is the highest it’s been since 1981, the real rate of borrowing is negative if you borrow at a rate below 6.8%. Simply put, you’re getting paid to borrow! We don’t expect this phenomenon to last long — it’s a fairly unique situation.

The market remains competitive for buyers, but conditions are making it an exceptional time for homeowners to sell. Low inventory means sellers will receive multiple offers with fewer concessions. Because sellers are often selling one home and buying another, it’s essential that sellers work with the right agent to ensure the transition goes smoothly.

|

Home prices still have room to run in 2022

|

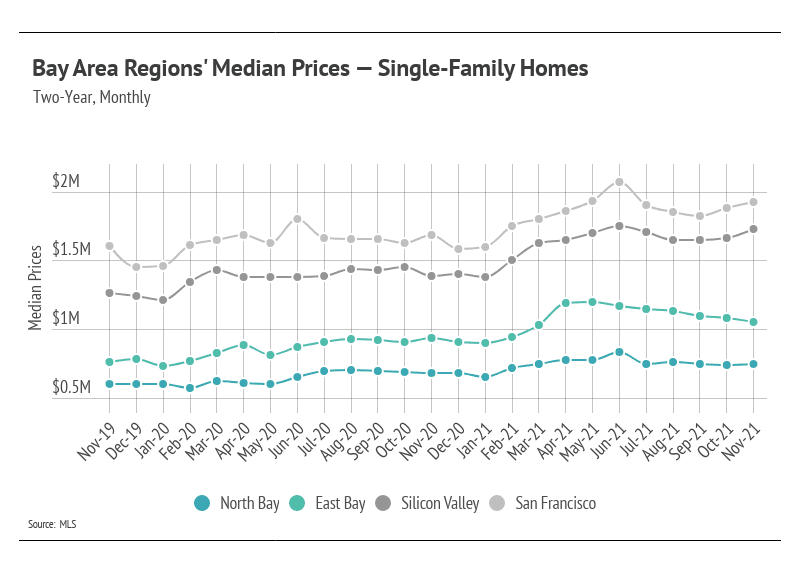

After single-family home prices appreciated significantly in the first half of 2021, it makes sense that prices would decline in the third and fourth quarters. North and East Bay prices experienced the most substantial decrease in the second half of the year, although all regions declined. However, as inventory continues to decline, as is typical in the winter season, prices will likely increase.

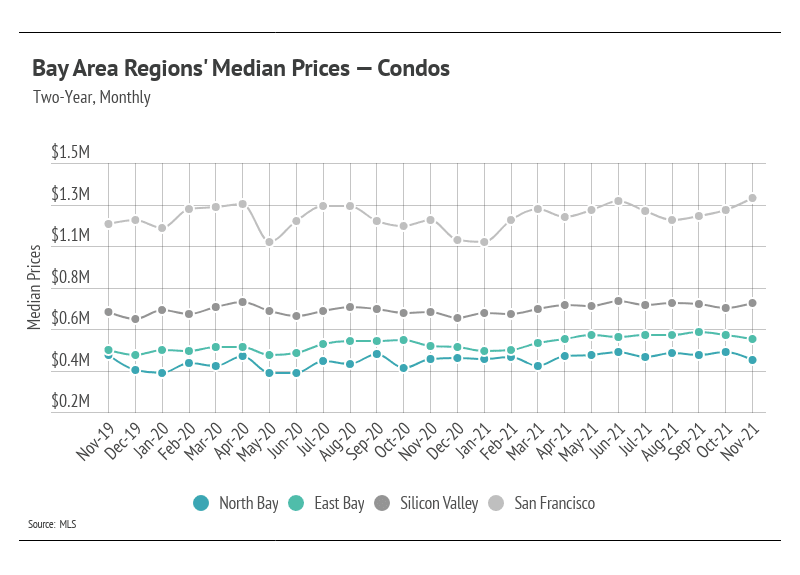

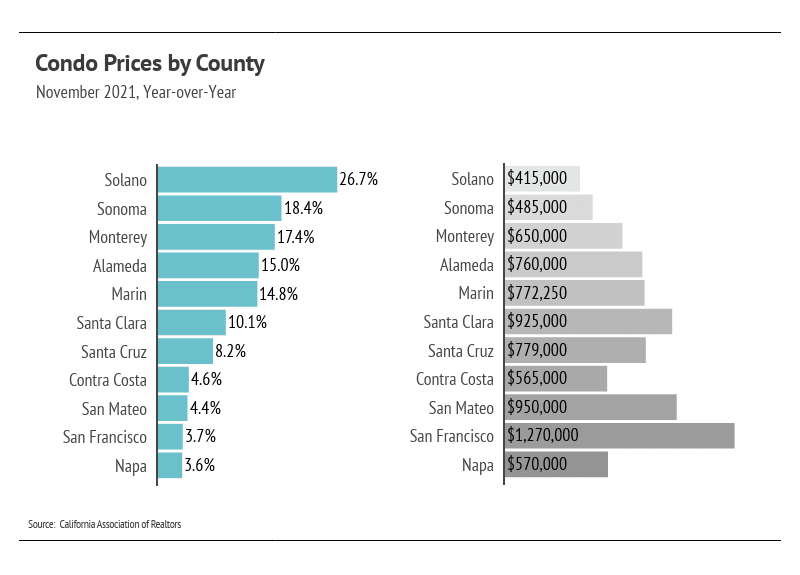

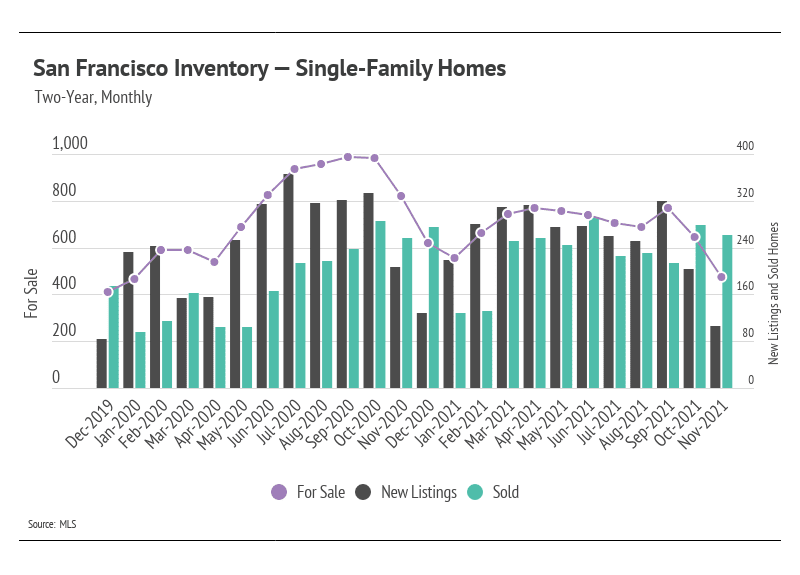

Condo prices declined less significantly in the second half, and San Francisco condos increased to a record high in November. This is the first new high we’ve seen in over a year in San Francisco. The pandemic hit demand for condos hard, but price and sales indicate that demand is back. Although the price appreciation wasn’t as pronounced for condos as it was for single-family homes, we expect price appreciation to slow as we move through the winter months, a seasonal norm.

Condo prices declined less significantly in the second half, and San Francisco condos increased to a record high in November. This is the first new high we’ve seen in over a year in San Francisco. The pandemic hit demand for condos hard, but price and sales indicate that demand is back. Although the price appreciation wasn’t as pronounced for condos as it was for single-family homes, we expect price appreciation to slow as we move through the winter months, a seasonal norm.

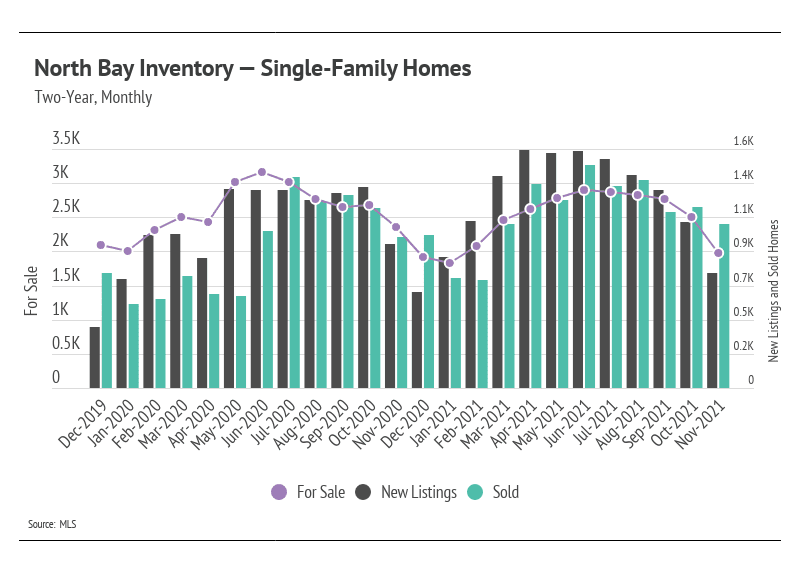

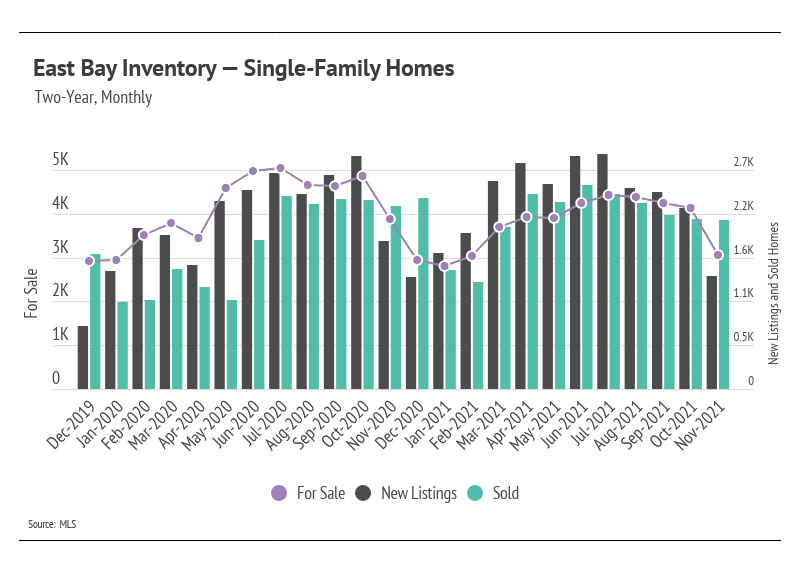

Nearing record low inventory once again

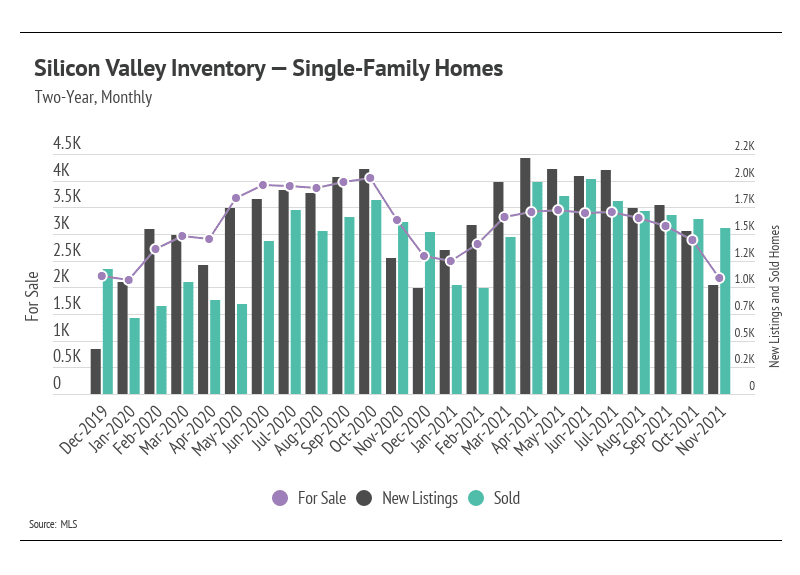

Despite the slight increase in single-family home inventory in the first half of 2021, the sustained high demand and lack of new listings in the second half brought single-family home and condo supply to near historic lows. Once again, we are seeing that far more people want to live in the Greater Bay Area than want to leave. Sales in the Bay Area have been incredibly high, especially when accounting for available inventory, again highlighting demand. Sellers can expect multiple offers, and buyers should come with competitive offers.

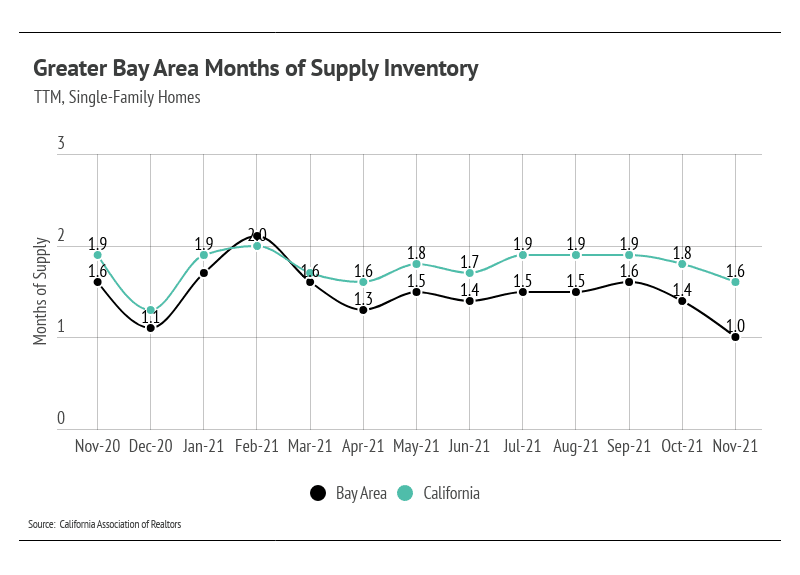

Months of Supply Inventory further indicates high demand

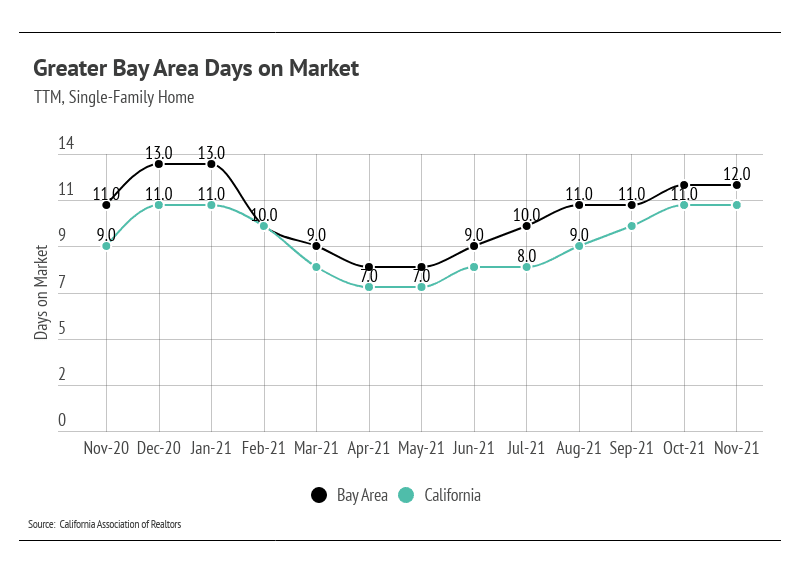

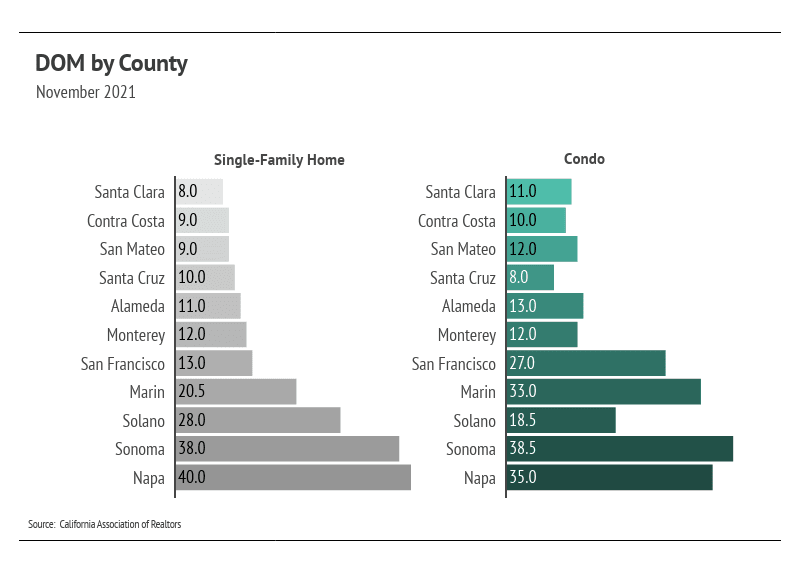

Homes are still selling extremely quickly. The Days on Market reflects the high demand for homes in the Greater Bay Area. Buyers must put in competitive offers above the list price of the home.

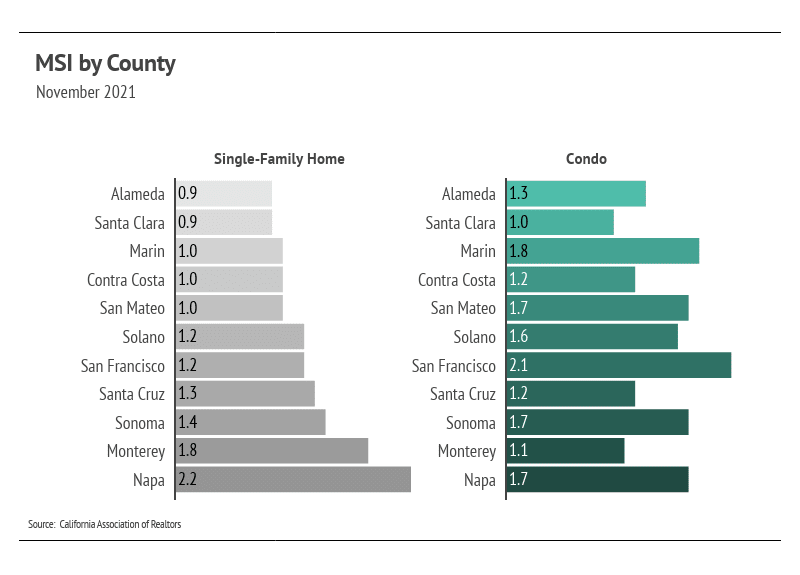

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes for sale on the market to sell at the current rate of sales. The average MSI is three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). MSI in the Greater Bay Area is historically low for single-family homes and condos, indicating a strong sellers’ market.

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes for sale on the market to sell at the current rate of sales. The average MSI is three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). MSI in the Greater Bay Area is historically low for single-family homes and condos, indicating a strong sellers’ market.